INVESTMENTS

In addition to its property portfolio and Toyota distribution, over which the Group has more direct day-to-day management oversight, Perron Group also derives income from a range of diversified investments.

LISTED EQUITIES

The Group invests in listed equities with its portfolio managed by JANA Investment Advisors, who advise on the structure, selection and monitoring of fund managers. The portfolio contains significant shareholdings in companies listed on the Australian Stock Exchange and overseas markets.

PRIVATE EQUITY

The Group has recently sought to diversify its portfolio via investment in private equity — initially spread across three different fund managers. Perron Group’s foray into private equity is relatively conservative in nature and scale. However, subject to market conditions and return expectations, funds invested in this asset class are anticipated to grow over time.

INFRASTRUCTURE

Perron Group’s infrastructure portfolio comprises holdings in unlisted Australian airports and unlisted infrastructure funds.

The Group’s investments in the unlisted airport sector are compromised of the following:

Queensland Airports Ltd (Gold Coast, Townsville, Mount Isa and Longreach)

North Queensland Airports Ltd (Cairns and Mackay)

Adelaide Airport Ltd (Adelaide and Parafield)

Outside of airports, the Group has an indirect investment in two infrastructure funds:

Global Diversified Infrastructure Fund (GDIF) managed by Igneo Infrastructure Partners

The Utilities Trust of Australia (UTA), managed by Morrison & Co

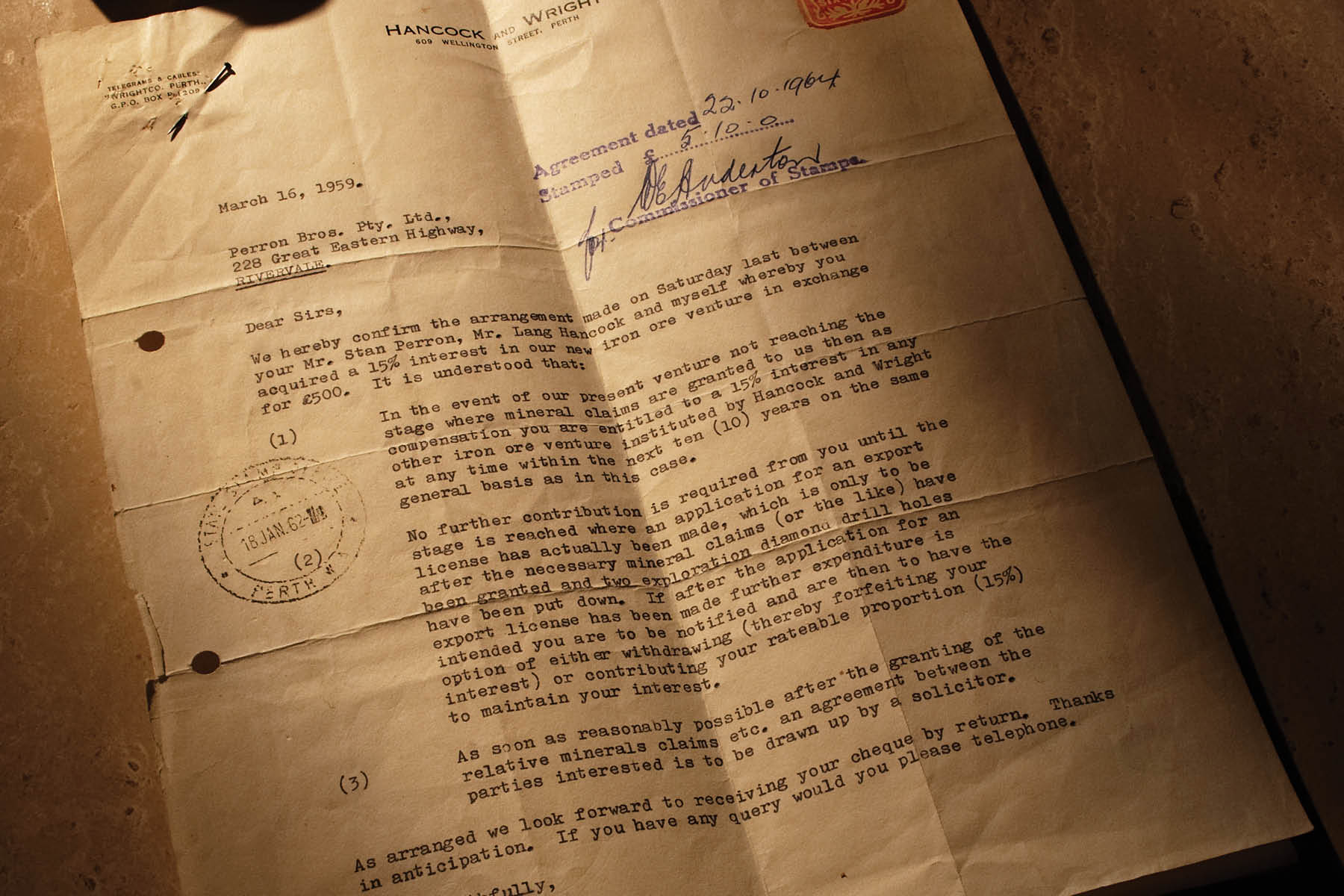

MINING ROYALTIES

Stan Perron’s historic investment in the early mining ventures of Hancock and Wright in the 1960s has provided an ongoing flow of iron ore royalties from several Rio Tinto operations in the Pilbara. The extent of annual royalties paid is subject to the price of iron ore and the level of tonnages shipped.

The royalty is currently paid on ore from the Mt Tom Price, Brockman, Nammuldi and Western Turner mines.

Perron Group will be entitled to royalties from any other mine sites developed by Rio Tinto pursuant to the Royalty Agreement for the foreseeable future.